Institutional Coverage of Worldwide

Interest Rates, Debt & Money with

Global Rates & Money Flows

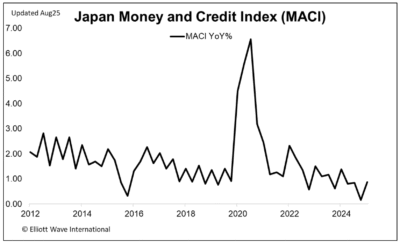

Murray Gunn and Elliott Wave International are pleased to introduce an institutional service tailored to the needs of fixed-income and currency professionals. Global Rates & Money Flows combines technical savvy with a rigorous understanding of economic and monetary conditions to anticipate turns in global interest rates and capital flows.

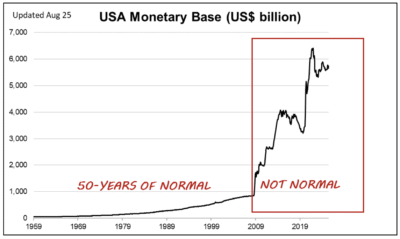

Unlike the standard macroeconomic analysis offered by banks and brokers, GRMF focuses on a specialized niche — applying the Elliott wave (fractal) model of price progression, backed by socionomic insights, technical readings and a macro-fundamental assessment. This combination gives institutions a sharp and unique perspective.

The service is overseen by Murray Gunn, who has 30 years’ experience analyzing markets from both inside and outside major institutions. Gunn is an expert elliottician and socionomist.

We think GRMF can serve as your primary analytical input. At minimum, you should add it to your arsenal.

Institutional Division Strategist

Core Deliverables

1. Flagship Monthly Publication

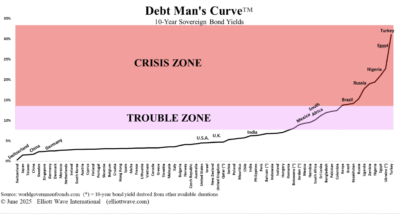

- Global Rates & Money Flows anticipates intermediate term trends and trend changes in government and corporate bond yields, currencies (including fiat, bullion and crypto), and capital movement.

- Gunn presents his insights with one-of-a-kind charts, explained in accessible language. He integrates investor psychology, herding behavior, social-mood analysis, economic conditions and implications from market structure, appealing to both technically and fundamentally oriented professionals.

2. Research Notes & Daily Commentary

- Gunn’s intra-month Research Notes and Daily Commentary are designed for quick consumption to support real-time decision making.

- Concise, high-frequency insights highlight more immediate developments in rates, flows and cross-market linkages.

3. Bespoke Institutional Access

- Direct Consultation: Institutions may access one-on-one discussions with Murray Gunn. Queries can range from the most popular instruments to Swedish government bond yields to Latin American-Yen cross-currency dynamics. Each query gets a customized response.

- Biannual On-Site Meetings: Gunn is available to meet in person with you and your institutional team twice per year. This provides the opportunity for in-depth strategy discussions.

- In-Person Training & CPD Credit: In addition to all these features, Gunn is available to provide on-site technical analysis training. He can deliver one- or two-day seminars covering the Elliott wave model, socionomics and analytical frameworks tailored to the institution’s needs. Such training often satisfies Continuous Professional Development (CPD) requirements.

Institutional Edge

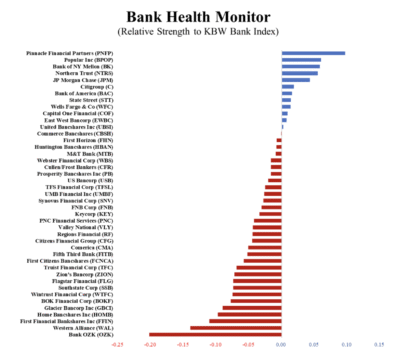

- Niche Specialization: GRMF is not a “macro-economic monthly.” It is a specialty service.

- Unique Framework: GRMF combines the Elliott wave model and socionomic herding theory along with other technicals and fundamentals, providing a perspective that isn’t available from mainstream sources.

- Transparency and Accountability: The service maintains a virtual portfolio to track market calls in real time.

Murray Gunn — Institutional Strategist

Murray Gunn brings more than three decades of experience in global markets to the GRMF service. As a bond and currency fund manager with Hambros, Standard Life Investments and the Abu Dhabi Investment Authority and then as Head of Technical Analysis at HSBC, Gunn has developed deep insight into fixed-income and currency markets.

Depending on your needs, Gunn is also situated to draw upon the expertise of 25 dedicated Elliott wave analysts who cover equities, commodities, FX, metals and fixed income for Elliott Wave International.

Subscription Details

- Annual Fee: $50,000 per institution; negotiable for smaller firms.

- Logins: Institutions receive a maximum number of logins based on firm size and annual fee.

- Access: Monthly research publication, daily and special notes, direct consultations, biannual in-person meetings, in-person training for CPD credit, continuous digital communication.

Or email Murray directly at GRMF@elliottwave.net

“My research weaves together herding behavior, social mood analysis, and Elliott wave structure to reveal hidden dynamics in global rates and cross-border money flows. This integrated approach helps clients anticipate turning points in yields and capital movement — and capture alpha others miss. I look forward to speaking to you about how this approach works.”

—